LIMITED TIME OFFER

Replace all of these

with a single tool for just $1 per month for your entire team

UNLIMITED USERS

UNLIMITED PROJECTS

UNLIMITED CHATS

UNLIMITED DOCS

UNLIMITED STORAGE

AND MORE..

Risk Assessment Metrics Explained

Risk assessment metrics (RAM) are essential tools for businesses in evaluating and managing risks effectively. By providing measurable data, these metrics help businesses make informed decisions, develop strategies, and maintain a proactive approach to risk management. Understanding risk assessment metrics is crucial for those responsible for assessing and mitigating risks within an organization.

Understanding Risk Assessment Metrics

At its core, risk assessment metrics seek to quantify and analyze different aspects of risk. These metrics enable businesses to identify, prioritize, and monitor risks, allowing for better risk management. To fully comprehend the significance of RAM, it is important to first understand their definition and importance, as well as the various types available.

Definition and Importance of Risk Assessment Metrics

Risk assessment metrics are quantitative measures used to assess the probability and potential impact of risks on business objectives. They provide a systematic approach to evaluating risks and determining their significance, allowing businesses to allocate resources and implement appropriate risk mitigation strategies. By understanding and utilizing risk assessment metrics, businesses can make informed decisions and take proactive steps towards minimizing potential losses and maximizing opportunities.

Furthermore, risk assessment metrics play a crucial role in enhancing transparency and accountability within organizations. By having a standardized framework for evaluating risks, businesses can ensure that all stakeholders have a clear understanding of the potential risks involved in various activities. This transparency not only helps in building trust with customers and investors but also fosters a culture of risk awareness and responsibility among employees.

Moreover, risk assessment metrics provide a basis for effective communication and collaboration among different departments within an organization. By using a common language to discuss and evaluate risks, departments can align their efforts towards addressing the most critical risks and work together to develop comprehensive risk management strategies. This collaborative approach not only enhances the overall effectiveness of risk management but also promotes a culture of cross-functional teamwork and problem-solving.

Different Types of Risk Assessment Metrics

There are numerous types of risk assessment metrics, each tailored to measure specific aspects of risks. Some common types include:

- Financial metrics: Measuring risks related to financial performance, such as revenue, profitability, and cash flow. These metrics provide insights into the financial stability and sustainability of a business, helping in identifying potential financial risks and developing appropriate risk mitigation strategies.

- Operational metrics: Focusing on risks associated with operational processes, including supply chain management, production capabilities, and delivery performance. These metrics help businesses identify operational vulnerabilities and inefficiencies, allowing for proactive risk management and process improvement.

- Compliance metrics: Assessing risks related to regulatory compliance, ensuring adherence to laws, rules, and industry standards. These metrics help businesses identify potential compliance gaps and develop strategies to mitigate legal and regulatory risks, avoiding costly penalties and reputational damage.

- Market metrics: Analyzing risks arising from market conditions and competition, such as market share, customer demand, and pricing fluctuations. These metrics provide insights into market dynamics and help businesses anticipate and respond to changing market trends, ensuring competitiveness and sustainability.

By utilizing a combination of these different types of risk assessment metrics, businesses can gain a comprehensive understanding of their risk landscape and make informed strategic decisions. It is important to note that the selection and customization of RAM should be based on the specific needs and objectives of each business, ensuring that the metrics align with the industry, organizational structure, and risk appetite.

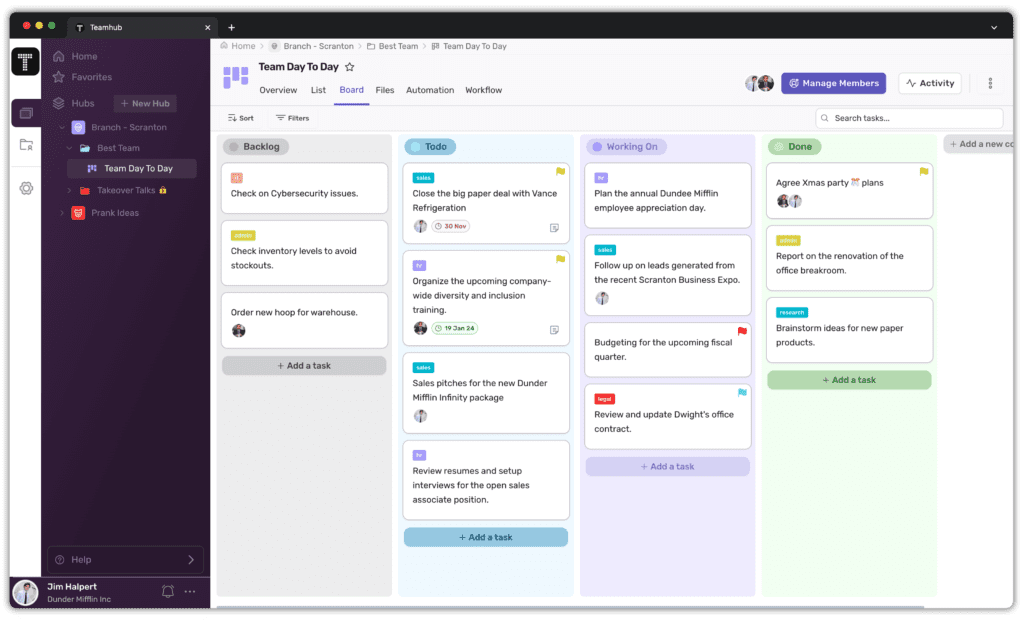

Unlock Efficiency with Teamhub

The Role of Risk Assessment Metrics in Business

Risk assessment metrics play a crucial role in various aspects of business operations, from decision making to strategic planning. Understanding how to leverage these metrics is essential for optimizing business performance and maintaining sustainable growth.

Structured approach to evaluating risks

When it comes to managing risks in business, having a clear understanding of the potential threats and their potential impact is vital. RAM provides a structured approach to evaluating risks, allowing organizations to make informed decisions and take appropriate actions.

Valuable insights

One of the key areas where risk assessment metrics are particularly valuable is in decision making. When faced with a decision that involves potential risks, utilizing risk assessment metrics can provide valuable insights and mitigate uncertainties. By quantifying and evaluating risks, decision-makers can assess the potential impact and probability of different outcomes, enabling them to make informed choices that align with the organization’s risk appetite and strategic objectives.

Assess the potential risks

For example, imagine a company considering expanding its operations into a new market. By using risk assessment metrics, the company can assess the potential risks associated with this expansion, such as market volatility, regulatory challenges, and competitive landscape. These metrics can help the company evaluate the potential rewards and risks, allowing them to make an informed decision on whether to proceed with the expansion or explore alternative strategies.

Integral to strategic planning processes

In addition to decision making, risk assessment metrics are integral to strategic planning processes. By analyzing risks associated with different courses of action, businesses can identify potential roadblocks, prioritize resources, and develop mitigation strategies. These metrics allow organizations to align their strategic plans with the risk landscape, ensuring proactive risk management and increasing the likelihood of success.

For instance, a company in the technology industry may use risk assessment metrics to evaluate the potential risks of developing a new product. By considering factors such as technological feasibility, market demand, and intellectual property protection, the company can assess the risks associated with the product development process. This information can then be used to inform the strategic planning process, allowing the company to allocate resources effectively and develop contingency plans to address potential risks.

Monitor and evaluate the effectiveness of risk management strategies

Furthermore, risk assessment metrics can also be used to monitor and evaluate the effectiveness of risk management strategies. By regularly assessing and measuring risks, organizations can identify trends, evaluate the impact of risk mitigation measures, and make necessary adjustments to their strategies. This ongoing monitoring and evaluation process can help businesses stay agile and responsive to changing risk landscapes.

In conclusion, risk assessment metrics are invaluable tools for businesses in managing risks and making informed decisions. By leveraging these metrics in decision making and strategic planning, organizations can effectively evaluate risks, prioritize resources, and develop proactive risk management strategies. Ultimately, this enables businesses to navigate uncertainties and optimize their performance in a rapidly changing business environment.

How to Interpret Risk Assessment Metrics

Reading and understanding risk assessment metrics correctly is vital to their effective utilization. To derive meaningful insights from these metrics, users must consider various factors and avoid common pitfalls when interpreting the data.

Reading and Understanding Risk Metrics

When interpreting risk assessment metrics, it is important to assess the context in which the metrics were derived. Factors such as the data source, time frame, and industry benchmarks should be taken into account. Additionally, understanding the limitations and assumptions of the metrics is crucial for accurate interpretation.

For example, if the RAM were derived from a small sample size or outdated data, the results may not accurately reflect the current risk landscape. It is essential to ensure that the data used for the metrics is representative and up-to-date.

Furthermore, industry benchmarks provide valuable context for interpreting risk assessment metrics. Comparing the organization’s metrics to industry standards can help identify areas of strength or weakness. However, it is important to consider that benchmarks may vary across industries, so a thorough understanding of the specific industry’s risk landscape is necessary.

Another aspect to consider when interpreting risk metrics is the assumptions made during their calculation. Risk assessment metrics often rely on certain assumptions about the underlying data and the relationship between different variables. Understanding these assumptions is crucial to avoid misinterpretation and drawing incorrect conclusions.

Pitfalls to Avoid When Interpreting Risk Metrics

Interpreting risk assessment metrics can be challenging, and several pitfalls should be avoided. One common mistake is relying solely on quantitative metrics while neglecting qualitative factors and subjective judgment. While quantitative metrics provide valuable insights, they may not capture the full complexity of risks. It is important to consider qualitative factors such as the organization’s culture, management practices, and external influences that may impact the overall risk profile.

Additionally, it is crucial to regularly update and adjust risk assessment metrics to reflect changes in the organization’s risk landscape. Failing to do so can lead to misleading interpretations and ineffective risk management strategies. External factors such as regulatory changes, market fluctuations, or emerging risks can significantly impact the organization’s risk profile. Therefore, it is essential to review and update risk assessment metrics regularly to ensure their relevance and accuracy.

Another pitfall to avoid is overreliance on a single metric or a narrow set of metrics. Risk assessment is a multidimensional process, and relying on a single metric may oversimplify the complexity of risks. It is important to consider a range of metrics that capture different aspects of risk, such as likelihood, impact, and velocity, to develop a comprehensive understanding of the organization’s risk profile.

In conclusion, effectively interpreting risk assessment metrics requires considering various factors such as the context, limitations, and assumptions of the metrics. It is crucial to avoid common pitfalls, including neglecting qualitative factors, failing to update metrics regularly, and overreliance on a single metric. By taking these considerations into account, users can derive meaningful insights from risk assessment metrics and make informed decisions to manage and mitigate risks.

Implementing Risk Assessment Metrics

For businesses looking to enhance their risk management practices, implementing risk assessment metrics is a critical step. This process involves incorporating these metrics into the organization’s framework and ensuring their relevance and effectiveness.

Steps to Incorporate Risk Metrics in Your Organization

When implementing risk assessment metrics, organizations should follow key steps to ensure success. These steps may include:

- Identifying relevant metrics based on the organization’s risk profile and objectives.

- Developing a framework for data collection and analysis.

- Assigning responsibility for monitoring and reporting on risk metrics.

- Regularly reviewing and updating the metrics to reflect changes in the risk landscape.

By following these steps, organizations can establish a robust system for measuring and managing risks effectively.

Maintaining and Updating Your Risk Assessment Metrics

Risk assessment metrics are not static; they require regular maintenance and updating to remain relevant in a dynamic business environment. Organizations should periodically review and adjust their risk assessment metrics to reflect changes in the internal and external risk landscape. By doing so, businesses can ensure that the metrics continue to provide accurate and meaningful insights for effective risk management.

The Future of Risk Assessment Metrics

As organizations continue to navigate an increasingly complex and interconnected world, the field of risk assessment metrics is evolving to meet new challenges and leverage technological advancements.

Emerging Trends in Risk Assessment Metrics

Emerging trends in risk assessment metrics include the integration of big data analytics and artificial intelligence technologies. These advancements enable businesses to gather and analyze vast amounts of data in real-time, enhancing their ability to identify, analyze, and respond to risks promptly and effectively. Furthermore, the increasing use of predictive analytics allows organizations to anticipate and mitigate potential risks before they occur, minimizing their impact on business operations.

The Impact of Technology on Risk Assessment Metrics

Technology plays a significant role in shaping the future of risk assessment metrics. Automation, machine learning, and cognitive computing are revolutionizing risk management processes by enabling more accurate and efficient risk assessment and monitoring. By leveraging technology-driven risk assessment metrics, businesses can gain a competitive edge by effectively managing risks, protecting their assets, and seizing opportunities for growth.

In conclusion, risk assessment metrics are powerful tools that enable businesses to evaluate and manage risks proactively. Understanding the definition, importance, and different types of risk assessment metrics provides valuable insights for decision-making and strategic planning. By interpreting these metrics correctly and avoiding common pitfalls, businesses can derive meaningful insights to drive their risk management practices. Implementing and maintaining risk assessment metrics within the organization ensures continued effectiveness, while embracing emerging trends and technology ensures readiness for the future. By leveraging risk assessment metrics, businesses can stay ahead of potential risks and make informed decisions to achieve long-term success.