LIMITED TIME OFFER

Replace all of these

with a single tool for just $1 per month for your entire team

UNLIMITED USERS

UNLIMITED PROJECTS

UNLIMITED CHATS

UNLIMITED DOCS

UNLIMITED STORAGE

AND MORE..

Budget Projection Calculation Explained

In today’s ever-changing financial landscape, budget projection calculation has become an essential tool for individuals and businesses alike. By providing a forecast of income and expenses over a specific period, budget projection helps in making informed financial decisions and planning for the future. Whether you are saving for a major purchase, managing your personal finances, or running a business, understanding the basics of budget projection is crucial.

Understanding the Basics of Budget Projection

Before delving into the intricacies of budget projection calculation, let’s explore its definition and importance.

Budget projection, also known as financial forecasting, is the process of estimating future income and expenses based on historical data and anticipated changes. It involves creating a comprehensive financial plan that enables individuals and businesses to anticipate cash flow, plan investments, and set financial goals.

The importance of budget projection cannot be overstated. It provides a roadmap for financial decision-making, enhances financial discipline, and enables informed long-term planning. It allows individuals and businesses to identify potential financial challenges and take proactive measures to mitigate them. Additionally, budget projection serves as a benchmark against which actual financial performance can be measured, facilitating regular reviews and adjustments.

Now, let’s dive deeper into the key components of a budget projection.

Key Components of a Budget Projection

To create an accurate budget projection, it is important to consider the key components that influence financial outcomes:

Income

This includes all sources of revenue, such as salaries, rental income, dividends, and interest.

When estimating income for a budget projection, it is essential to consider both regular income sources and any potential changes or fluctuations. For example, if you are self-employed, your income may vary from month to month. Additionally, if you have investments, you need to account for the potential fluctuations in dividend or interest income.

Expenses

These encompass all costs incurred, including rent, utilities, groceries, transportation, loan payments, and entertainment.

When estimating expenses, it is important to be thorough and consider all possible expenditures. This includes fixed expenses such as rent or mortgage payments, utilities, and insurance premiums, as well as variable expenses such as groceries, transportation costs, and entertainment. It is also important to account for any upcoming major expenses, such as home repairs or medical bills, that may impact your budget.

Savings and Investments

Setting aside funds for savings and investments is vital to secure future financial stability and achieve long-term goals.

While budget projections primarily focus on income and expenses, it is crucial to allocate a portion of your income towards savings and investments. This ensures that you have a financial safety net and can work towards achieving your long-term financial goals, such as buying a house, funding your children’s education, or planning for retirement. By including savings and investments in your budget projection, you can track your progress towards these goals and make adjustments as needed.

Debt

Existing debt obligations, such as loans and credit card balances, should be factored into the budget projection to determine the available discretionary income.

When creating a budget projection, it is important to consider any existing debt obligations. This includes loans, credit card balances, and any other outstanding debts. By factoring in your debt payments, you can determine the amount of discretionary income available for other expenses or savings. It is also important to consider any potential changes in interest rates or repayment terms that may impact your debt payments.

Market and Economic Factors

Fluctuations in the economy, interest rates, and consumer behavior can significantly impact the accuracy of budget projections.

While budget projections are based on historical data and anticipated changes, it is important to recognize that external factors can influence financial outcomes. Market fluctuations, changes in interest rates, and shifts in consumer behavior can all impact your income and expenses. When creating a budget projection, it is important to stay informed about these factors and make adjustments as necessary to ensure the accuracy of your projections.

By considering these key components and incorporating them into your budget projection, you can create a comprehensive and accurate financial plan that will guide your financial decisions and help you achieve your long-term goals.

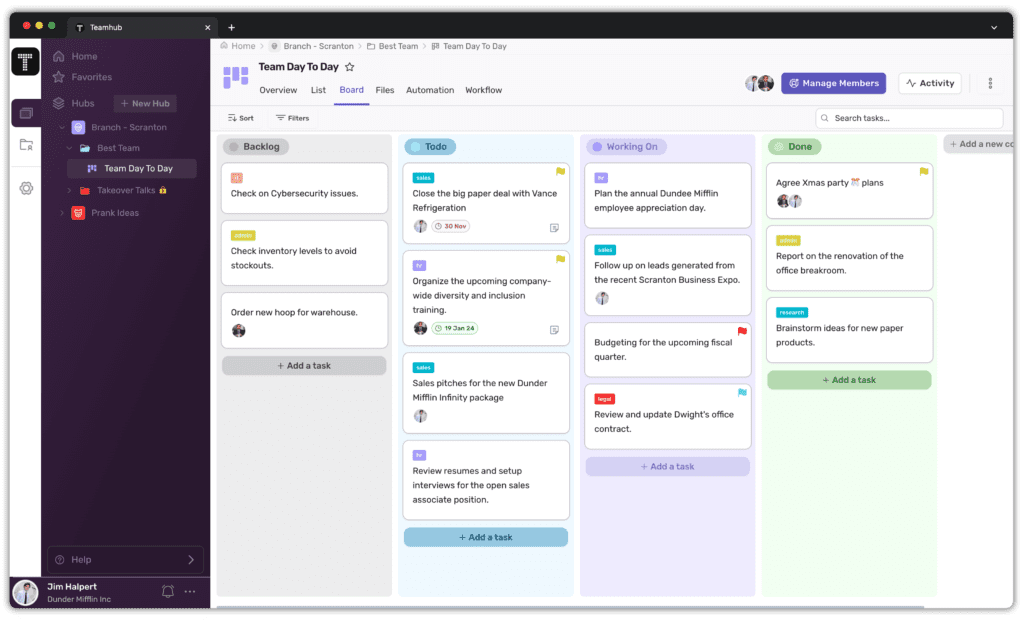

Unlock Efficiency with Teamhub

Steps in Budget Projection Calculation

Now that we have covered the basics, let’s explore the step-by-step process of budget projection calculation.

Identifying Financial Goals

The first step in budget projection calculation is identifying your financial goals. Whether you aspire to own a home, secure a comfortable retirement, start a business, or achieve any other financial milestone, defining your objectives provides direction to the budgeting process.

When identifying your financial goals, it is essential to be specific and realistic. Consider the timeline for achieving each goal and the financial resources required. By clearly defining your goals, you can align your budget projections with your long-term aspirations.

Estimating Income and Expenses

Accurately estimating your income and expenses is crucial for a realistic budget projection. Start by tracking your income sources, including your salary, investments, and any other sources of revenue. Categorize your expenses into fixed and variable costs to understand your spending patterns.

When estimating your income, consider any potential changes that may occur in the future. For example, if you anticipate a salary increase or a change in employment, account for these factors in your projections. Similarly, if you expect any major purchases or expenses, factor them into your budget calculations.

Adjusting for Inflation and Market Changes

Inflation and market changes can have a significant impact on budget projections. It is important to adjust for these factors to ensure the accuracy and relevance of your projections. Regularly monitoring market trends and economic indicators can aid in this process.

When adjusting for inflation, consider the historical inflation rate and any expected changes in the future. This will help you estimate how the purchasing power of your income may change over time. Additionally, stay informed about market changes that may affect your investments or any other sources of income.

By adjusting your budget projections for inflation and market changes, you can make more informed financial decisions and have a clearer understanding of your future financial situation.

Common Mistakes in Budget Projection Calculation

While budget projection calculation can be a powerful financial planning tool, it is not impervious to mistakes. Let’s explore some common errors to avoid.

Overestimating Income

One of the most common pitfalls in budget projection calculation is overestimating income. While it is crucial to be optimistic, it is equally important to be realistic and base income projections on reliable sources and historical data.

When overestimating income, individuals and businesses may find themselves in a precarious financial situation. It is essential to consider factors such as market conditions, customer demand, and potential risks that could affect income generation. By conducting thorough research and analysis, one can make more accurate income projections.

Moreover, relying solely on a single income source can be risky. Diversifying income streams can provide stability and reduce the chances of overestimating income. Exploring new business opportunities or investing in different assets can be beneficial in this regard.

Underestimating Expenses

Underestimating expenses can quickly derail even the most well-intended budget projection. It is essential to consider all costs, including unexpected expenses and discretionary spending, to ensure a comprehensive and accurate budget projection.

When creating a budget projection, it is crucial to account for both fixed and variable expenses. Fixed expenses, such as rent, utilities, and loan payments, are relatively predictable. However, variable expenses, such as maintenance costs, marketing expenses, and employee benefits, can fluctuate and should be carefully estimated.

Additionally, it is essential to anticipate and plan for unexpected expenses, such as equipment breakdowns, legal fees, or emergency situations. By setting aside a contingency fund, individuals and businesses can mitigate the impact of unforeseen costs on their budget projections.

Ignoring Economic Factors

Disregarding market and economic factors can significantly impact the accuracy of budget projections. Stay informed about economic trends and adjust projections accordingly to mitigate potential financial risks.

Economic factors, such as inflation rates, interest rates, and consumer spending patterns, can directly influence income and expenses. Failing to consider these factors can lead to unrealistic budget projections and financial instability.

Regularly monitoring economic indicators and industry trends can help individuals and businesses make informed decisions when creating budget projections. By staying updated on market conditions, one can adjust their projections to align with the current economic climate and anticipate potential challenges or opportunities.

Furthermore, it is essential to assess the impact of economic factors on different aspects of the budget, such as pricing strategies, cost of goods sold, or employee wages. By incorporating these considerations into budget projection calculations, individuals and businesses can enhance the accuracy and reliability of their financial planning.

Tools and Techniques for Accurate Budget Projections

To enhance the accuracy of budget projections, various tools and techniques can be employed.

Spreadsheet Models for Budget Projections

Using spreadsheet models, such as Microsoft Excel or Google Sheets, can simplify the budget projection calculation process. These tools allow for the organization and manipulation of financial data, making it easier to track income, expenses, and savings.

Financial Software for Budget Planning

Financial software, such as Intuit’s Mint or Quicken, provides automated budgeting solutions. These applications integrate with bank accounts, credit cards, and investment platforms, allowing for real-time tracking of income and expenses. They also offer features like goal setting and financial analytics to facilitate informed decision-making.

Tips for Improving Your Budget Projection Accuracy

Accurate budget projections require regular review, adjustment, and a proactive approach to financial planning.

Regular Review and Adjustment of Projections

Financial circumstances can change rapidly. To maintain the accuracy of your budget projection, review and adjust it periodically. This ensures that your financial plan reflects current market conditions, income changes, and evolving financial priorities.

Seeking Professional Financial Advice

If the intricacies of budget projection calculation seem overwhelming, consider seeking professional financial advice. A certified financial planner can provide personalized guidance, assist in analyzing your financial situation, and help create accurate budget projections tailored to your unique needs.

In conclusion, budget projection calculation is a vital financial planning tool that enables individuals and businesses to make informed decisions, plan for the future, and achieve financial goals. By understanding the basics, avoiding common pitfalls, utilizing appropriate tools, and seeking professional advice when needed, you can enhance the accuracy and effectiveness of your budget projections. Remember, accurate budget projections serve as the foundation for financial success, providing a roadmap to a secure and prosperous future.