LIMITED TIME OFFER

Replace all of these

with a single tool for just $1 per month for your entire team

UNLIMITED USERS

UNLIMITED PROJECTS

UNLIMITED CHATS

UNLIMITED DOCS

UNLIMITED STORAGE

AND MORE..

Actual Cost (AC) Explained

In the world of business, understanding the concept of actual cost (AC) is crucial. As a metric used to determine the true cost of producing goods or services, actual cost provides valuable insights for businesses to make informed decisions. So, let’s dive into the definition and importance of actual cost, explore its components, learn how to calculate it, compare it to estimated cost, and understand its impact on profit margins.

Understanding the Concept of Actual Cost

Before we delve deeper into the specifics, let’s start by understanding what actual cost means. In simple terms, the actual cost refers to the true cost incurred in the production or provision of goods or services. It takes into account both direct and indirect costs associated with the production process, providing businesses with an accurate picture of their expenses.

When we talk about direct costs, we are referring to expenses that can be directly attributed to the production of a specific product or service. These costs include raw materials, labor, and any other resources that are directly used in the production process. On the other hand, indirect costs are expenses that are not directly tied to a specific product or service but are still necessary for the overall production process. These costs may include rent, utilities, administrative expenses, and other overhead costs.

Definition of Actual Cost

Actual cost, also known as real cost, is the total cost involved in the production of goods or services, including both direct and indirect costs. It reflects the actual expenses incurred rather than estimated or budgeted costs.

Understanding the concept of actual cost is crucial for businesses to accurately evaluate their financial performance. By calculating the actual cost, businesses can compare it with their budgeted or estimated costs to identify any discrepancies or areas where costs may have exceeded expectations. This information allows businesses to make informed decisions regarding their pricing strategies, cost-cutting measures, and overall financial planning.

Moreover, actual cost provides businesses with a comprehensive view of their expenses, enabling them to identify any inefficiencies or areas for improvement in their production processes. By analyzing the actual cost, businesses can pinpoint specific areas where costs can be reduced or optimized, leading to increased profitability and competitiveness in the market.

Importance of Actual Cost in Business

Accurately determining the actual cost is vital for businesses as it helps in various aspects of decision-making. It provides a clear understanding of the expenses involved in the production process, allowing businesses to evaluate the profitability of their operations, set appropriate pricing, and identify areas for cost optimization.

One of the key benefits of knowing the actual cost is the ability to assess the profitability of a product or service. By comparing the actual cost with the revenue generated from the sale of a product or service, businesses can determine whether they are making a profit or incurring losses. This information is crucial for making pricing decisions and ensuring that the business remains financially sustainable.

Furthermore, understanding the actual cost allows businesses to identify areas where costs can be reduced or optimized. By analyzing the different components of the actual cost, businesses can identify any inefficiencies in their production processes, such as excessive use of resources or high overhead expenses. This knowledge empowers businesses to implement cost-saving measures and improve their overall operational efficiency.

Additionally, knowing the actual cost provides businesses with a solid foundation for budgeting and financial planning. By having an accurate understanding of their expenses, businesses can create realistic budgets and allocate resources effectively. This helps in avoiding financial surprises and ensures that the business remains financially stable in the long run.

In conclusion, the concept of actual cost is essential for businesses to accurately assess their financial performance, make informed decisions, and optimize their production processes. By understanding and calculating the actual cost, businesses can gain a competitive edge in the market and achieve long-term financial success.

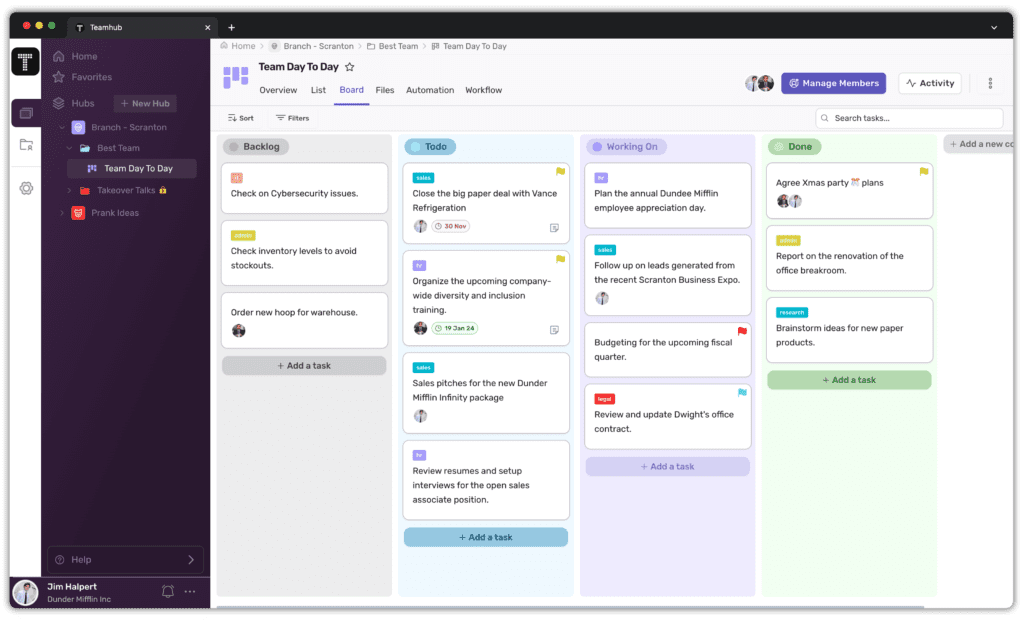

Unlock Efficiency with Teamhub

Components of Actual Cost

To accurately calculate the actual cost, it is essential to consider the two primary components: direct costs and indirect costs.

When it comes to determining the true cost of producing goods or providing services, businesses need to delve into the details of their expenses. By understanding the different components that make up the actual cost, companies can make informed decisions and ensure profitability.

Direct Costs

Direct costs are expenses that can be directly linked to the production of goods or services. These costs include raw materials, labor, and equipment directly involved in the manufacturing process. For example, in the production of a car, direct costs would include the cost of steel, rubber, and other materials used, as well as the wages of the assembly line workers and the machinery used to assemble the car.

Tracking direct costs is crucial for businesses as it allows them to ascertain the true cost of producing each unit of their product or providing each service. By accurately calculating direct costs, companies can determine the pricing strategy that will ensure profitability while remaining competitive in the market.

Indirect Costs

Indirect costs, also known as overhead costs, are expenses that are not directly tied to the production process. These costs encompass various operational expenses that are necessary for the business to function smoothly. While indirect costs may not be directly associated with a specific unit of production, they still contribute to the overall actual cost and must be considered for accurate calculations.

One of the most significant indirect costs for businesses is rent. Whether a company owns or leases its premises, there is a cost associated with the space it occupies. Rent is a fixed expense that needs to be factored into the actual cost, as it is essential for providing a physical location for production or service provision.

Utilities, such as electricity, water, and gas, are another example of indirect costs. These expenses are necessary for the day-to-day operations of a business, but they do not directly contribute to the production process. However, without utilities, businesses would not be able to function, making them an integral part of the overall actual cost.

Administrative salaries are also considered indirect costs. These include the wages of employees who work in departments such as human resources, finance, and administration. While these employees may not be directly involved in the production process, their roles are crucial for the smooth functioning of the business. Their salaries need to be factored into the actual cost to ensure accurate calculations.

Marketing expenses are another category of indirect costs. These costs include advertising, promotions, market research, and other activities aimed at promoting the business and its products or services. While marketing is essential for attracting customers and generating sales, it is not directly tied to the production process. However, it is still an integral part of the overall actual cost and needs to be considered for accurate calculations.

By considering both direct and indirect costs, businesses can gain a comprehensive understanding of the actual cost of producing goods or providing services. This knowledge enables companies to make informed decisions regarding pricing, cost-cutting measures, and overall profitability. Understanding the components of actual cost is a crucial aspect of financial management and strategic planning for any business.

Calculating Actual Cost

Calculating the actual cost involves considering several factors and following a systematic approach. Let’s explore the key factors influencing the actual cost calculation and the steps involved in the process.

Factors Influencing Actual Cost

Several factors can influence the actual cost calculation, including fluctuations in material prices, changes in labor costs, market conditions, and unforeseen events that impact the production process. It is important for businesses to monitor these factors and make adjustments accordingly to ensure accurate cost calculations.

Steps in Actual Cost Calculation

- Identify and track direct costs: Begin by tracking all direct costs associated with the production process. This includes raw materials, labor, and any other direct expenses incurred.

- Track indirect costs: Next, identify and track all indirect costs, such as rent, utilities, and administrative expenses. Ensure these costs are allocated appropriately to reflect their impact on the production process.

- Sum up direct and indirect costs: Once all costs are identified and tracked, add up the direct and indirect costs to determine the total actual cost incurred in production.

Actual Cost vs. Estimated Cost

While actual cost provides insights into the true expenses incurred, it is important to differentiate it from estimated cost. Let’s explore the key differences and similarities between these two metrics and understand why discrepancies may occur.

Key Differences and Similarities

Estimated cost is a prediction or approximation of the expenses involved in the production process, whereas actual cost represents the real expenses incurred. Estimated cost serves as a budgeting or planning tool, while actual cost provides an accurate reflection of the expenses. Discrepancies between estimated and actual costs can arise due to various factors, such as changes in input prices, unexpected events, or inaccurate initial estimations.

Why Discrepancies Occur

Discrepancies between estimated and actual costs can occur due to several reasons. Changes in market conditions, fluctuations in material prices, errors in estimating quantities or labor costs, and unforeseen events impacting the production process can all contribute to variations between estimated and actual costs. By understanding these discrepancies, businesses can refine their estimation processes and improve cost management.

Impact of Actual Cost on Profit Margins

Actual cost plays a crucial role in determining the profitability of a business. By accurately calculating the actual cost, businesses gain valuable insights into their profit margins and can implement strategies to enhance their financial performance.

Role of Actual Cost in Profit Calculation

Actual cost directly influences profit calculation by providing an accurate representation of the expenses incurred. By subtracting the actual cost from the revenue generated, businesses can determine their profit margins. This information allows businesses to assess the profitability of their operations, make informed pricing decisions, and identify areas where cost-reduction measures can be implemented.

Strategies for Controlling Actual Cost

Controlling actual costs is crucial for optimizing profitability. Businesses can employ several strategies to effectively manage their expenses, such as streamlining production processes, negotiating better supplier contracts, implementing cost-saving initiatives, and continuously monitoring and analyzing cost data. By incorporating these strategies, businesses can maintain control over actual costs and maximize their profit margins.

Final Thoughts

Understanding the concept of actual cost is essential for businesses to make informed decisions and optimize their profitability. By considering the definition and importance of actual cost, its components, calculation methods, and its comparison to estimated cost, businesses can gain valuable insights for cost management and financial performance improvement. By implementing effective strategies to control actual costs, businesses can enhance their competitiveness and achieve sustainable growth.